Why invest in Rivco Australia?

Rivco Australia provides investors with access to a defensive and largely uncorrelated asset class within Australia’s regulated water markets. Our investment thesis is built on the growing long-term demand for secure and reliable water, supported by the continued expansion of Australia’s permanent cropping industries. At the same time, the consumptive pool available to agriculture has been gradually reduced as water is returned to the environment through government recovery programs. These fundamentals have supported the value of water entitlements over time.

Rivco’s diversified portfolio and active management approach are structured around these long-term drivers, delivering steady lease income, while maintaining the potential for capital appreciation over time.

Rivco Australia Share Price (ASX:RIV)

Key Portfolio Metrics*

$291 million

58.8 gigalitres

53%

3.6 years

* As at 31 October 2025

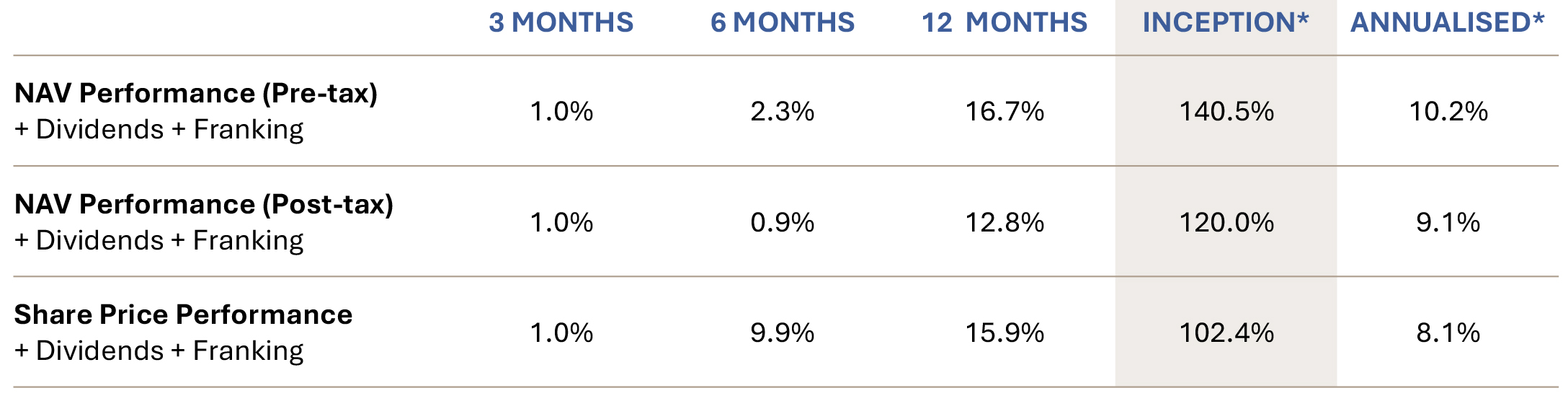

Company Performance – Since Inception*

*For the period 30 September 2016 to 30 September 2025.

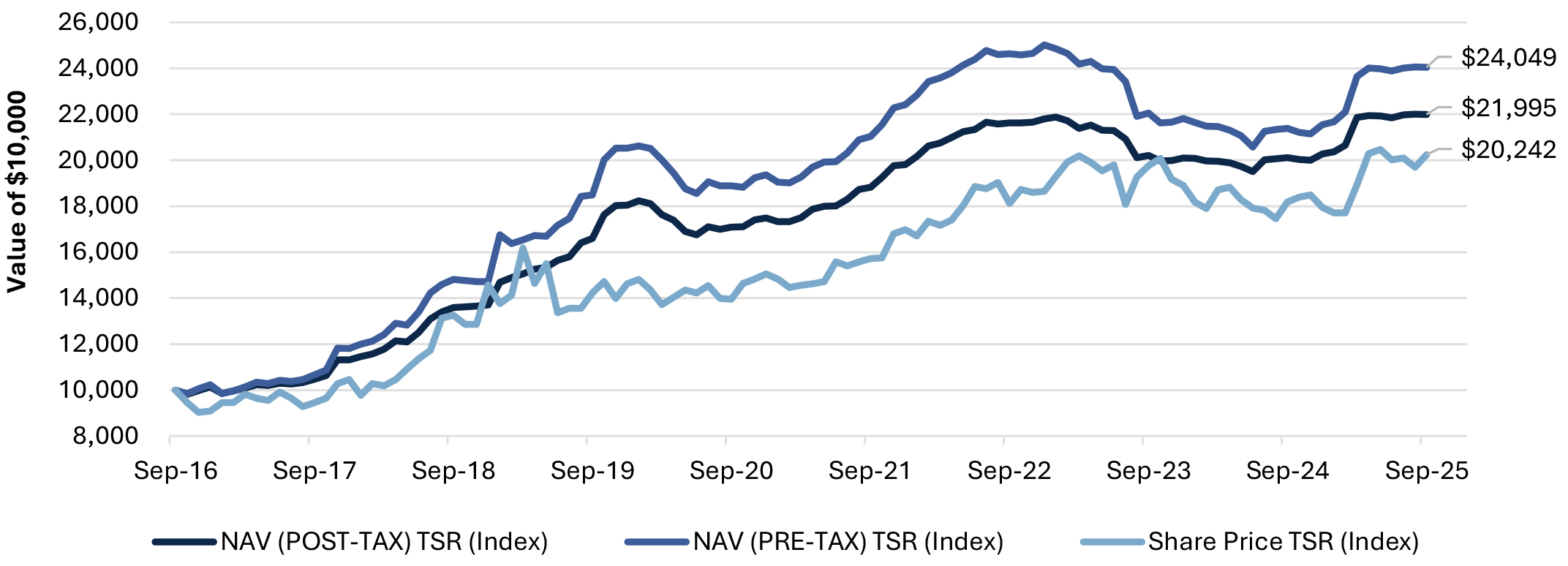

Growth of $10,000 – Since Inception*

*For the period 30 September 2016 to 30 September 2025.

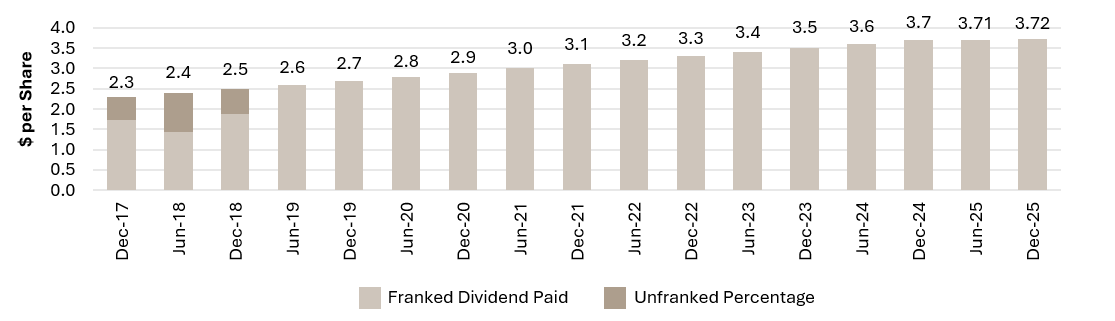

Dividends

Rivco Australia paid its most recent fully franked dividend of 3.72 cents per share on 31 October 2025. This brings total dividends paid to shareholders to 52.4 cents per share. Rivco Australia remains committed to its bi-annual dividend program, reflecting a disciplined and consistent approach to returning capital to shareholders.

Subscribe for regular updates

Our latest updates and reports

See our latest investor reports and factsheets below:

Our latest announcements

ASX Announcements and Corporate Governance

Corporate Governance

Rivco Australia’s corporate governance statement outlines the core elements of our governance framework and details our compliance with the ASX Corporate Governance Council’s Principles and Recommendations.